Get Support

0421.938.856

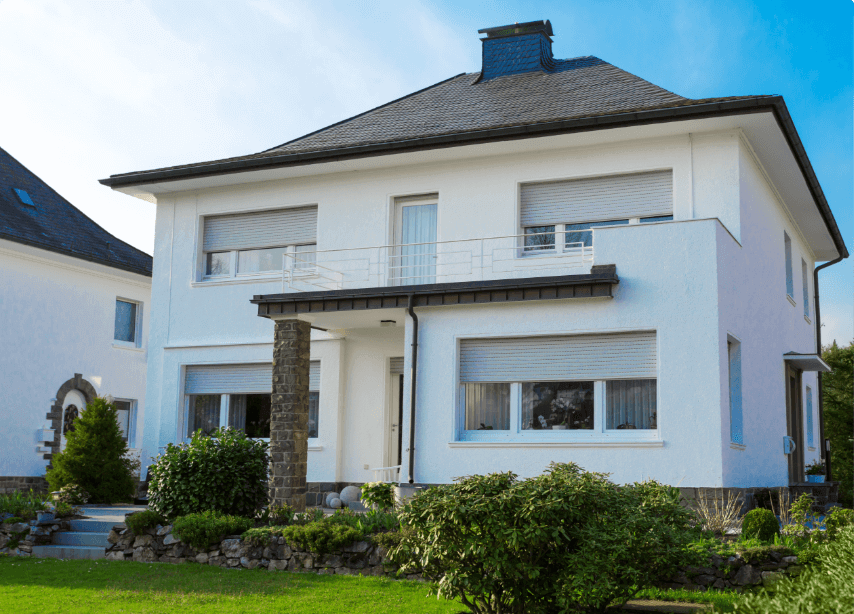

Why Property Is Still the Best Long-Term Investment

When it comes to building long-term wealth, few strategies have stood the test of time like property investment. While markets may fluctuate and trends evolve, owning real estate continues to offer stability, security, and strong returns over the years. Here’s why investing in property — especially a brand new home — is still one of the smartest financial decisions you can make.

1. Property Grows in Value Over Time

Unlike many other assets, real estate typically appreciates over the long term. With population growth, land scarcity, and demand for quality housing, home values tend to rise — especially in well-located suburbs.

2. It Offers Passive Rental Income

Investing in a second property or building with rental in mind can generate consistent income. Whether you lease part of your home or own a separate dwelling, rental returns can help offset mortgage costs and provide cash flow.

3. Tax Advantages for Investors

Property investors in Australia enjoy several tax benefits, including depreciation, negative gearing, and capital gains concessions. These can significantly boost your overall return on investment when planned correctly.

4. Tangible and Secure Asset

Unlike stocks or digital investments, property is a physical asset — something you can see, improve, and leverage. It's less prone to volatility and gives many buyers peace of mind.

5. Better Than Paying Rent

When you buy a home, you’re investing in your own future — not your landlord’s. Mortgage payments build equity over time, whereas rent offers no long-term return.

Thinking of starting your investment journey?

A brand new Radison home is a future-proof investment with quality construction, energy efficiency, and flexible floor plans for modern living. Let’s build wealth — and your dream home — together.

Looking for a dream home?

We can help you realize your dream of a new home